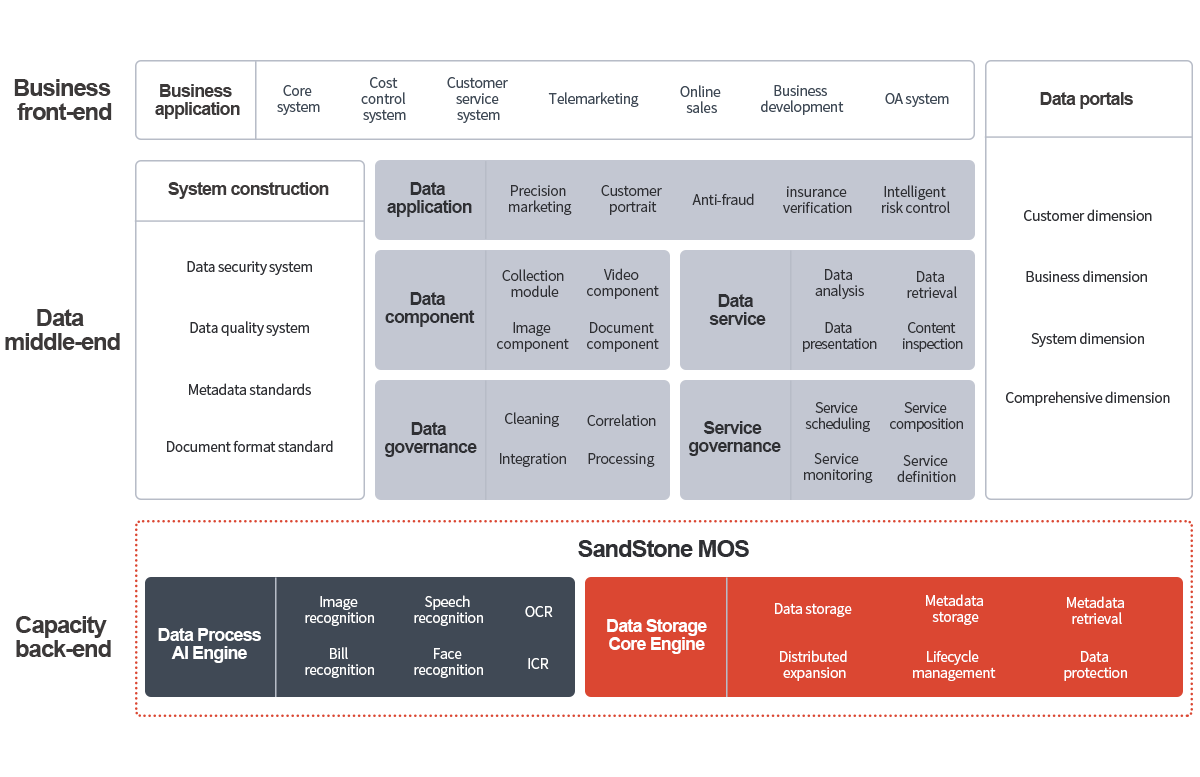

In the process of digital transformation driven by fintech science and technology, the financial industry needs to be competent for fast iterative upgrading of Internet companies for driving business development based on data, so it needs to construct one-stop technical capacities, unified data management capacities and capacities for fast configuration and business development. The data and technical convergence brought by digital transformation has accelerated the demands for data middle-end construction. The SandStone solution for unstructured data middle-end can help financial customers integrate data and technical resources and build up a unified interface service platform.

Business front-end:Support the core system, cost control system, customer service system, mobile business development and OA system. According to the principle of “small front-end, strong middle-end and large back-end”, let the agile small front-end connected with various external personalized demands.

Data middle-end:For the financial business system, it should provide unstructured data, such as video, images, document collection and display and other components; provide content retrieval and analysis API for certificates, bills, voice and texts; provide a data portal to enable the management of unstructured data documents.

Capacity back-end:It should provide unified intelligent storage, competent for mass data storage, metadata retrieval, data lifecycle management, use of plug-in AI framework, integration of the AI capacities in the financial industry and extraction of the valuable information from unstructured data.

Platform-oriented ability, rapid development response

Service-oriented collection, display, quality inspection, identification and review capacities

Simplify application development and support rapid application release

Processing once for multiple applications to avoid repeated development and processingCross-business data connectivity for efficient utilization

Platform-oriented storage architecture to achieve data sharing and simplified management between business systems

Realize data integration, analysis and utilization across businesses, and avoid information island

EB-level capacity flexible expansion, able to support high concurrent access to 10 billion files and support large-scale business groupsPlatform governance for the financial industry

Achieve unified management and control of the infrastructure resources in the capacity back-end; achieve unified data management and governance in the data middle-end, and provide unique credible data service

The service capacity of SandStone in the financial industry can help customers achieve systematic and standardized data platform governance